Friday, February 12, 2016 at 3:38AM

Friday, February 12, 2016 at 3:38AM Economically the world is okay because it is growing - just not at the pace we have grown accustomed to. Nonetheless, GDP is still growing. Of the 58 countries the Economist tracks, only seven experienced declining GDP in their most recent quarter. These were mostly countries that will always have economic difficulty and are located in Africa and South America – so, no big threat. The same can be said about falling consumer prices.

Unemployment is growing in tandem with commodity prices across some economies. However, employment growth across the globe outweighs the losses. That is not to say that we are out of the woods yet. With record debt levels in a global economy where jobs are shrinking, deleveraging (debt reduction) is a guarantee. With it comes a slower economy.

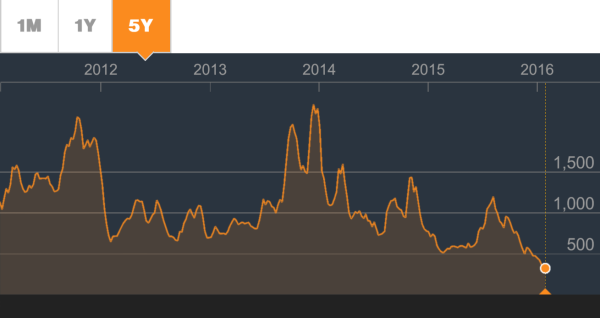

The CRB tracks the essential ingredients of the economy. The Baltic Dry measures the price of shipping these ingredients around the world. Both are at all-time lows. This means both consumer spending and business investment has contracted. I live in North Vancouver and see the Port of Vancouver every day. The shipping has slowed noticeably.

CRB Index

Baltic Dry Index

The only thing that will speed up the deleveraging process is if the central banks start to reward the saver with higher interest rates, rather than accommodate the borrower with lower ones. Let’s be honest, the average consumer is clueless when it comes to finances. If they weren’t, household debt in many economies would not be at record highs. We can blame the lender, but at the end of the day it is the borrower that signed the dotted line. It’s like giving my beagle, Julie, free access to food – she will pig out until she passes out. It will be the over-leveraged who will ultimately pay the price for taking on too much debt.

The over-leveraged are going to suffer no matter what interest rates do – higher ones will just get it done and over with much faster. Consumer debt levels are so high right now that it is literally impossible for them to pay it all back. In fact, it is reasonable to expect that 20% of consumers will soon experience some form of default whether it be a car loan, credit card, payday loan or a mortgage. Stock markets trade on future earnings and they are telling us that the consumer is tapped. Avoiding higher interest rates are doing nothing but slowing the inevitable.

So, what does one do in times like this? First, ignore the markets when they are volatile. There is nothing you can do about it. So do you sit it out or convert to cash? We are going to do both; not sell a thing and continue to allow the dividends to grow our cash holdings for future opportunities that lie ahead. This will be as soon as we see the CRB and Baltic Dry Index break their bear market.

History proves that markets bounce back within twelve months, three-quarters of the time. This jumps to almost 90% when one has a balanced portfolio of blue-chip dividend paying shares. Six of our recommendations have raised their dividend so far this year and we expect the majority to follow. Sacola’s buy-and-hold philosophy has not changed one bit – it’s just far more fun when the markets are rising.

Master | Comments Off |

Master | Comments Off |